|

Bandar Alkhorayaf, Saudi Arabia's Minister of Industry and Mineral Resources, revealed these plans during a recent visit to the South American nation.

Manara Minerals, a joint venture between Saudi state-owned miner Ma'aden and the Public Investment Fund (PIF), is at the forefront of this initiative. The company is currently analyzing various investment options in Chile, the world's second-largest producer of lithium.

"I think we can see something happening with Manara on the Chilean assets here. It makes a lot of sense," Alkhorayaf stated, noting the "great commitment" from the Chilean government to facilitate investment.

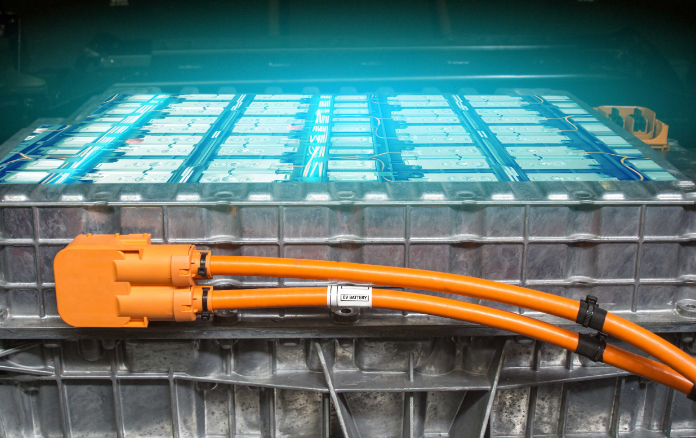

This push for lithium investment aligns with Saudi Arabia's broader strategy to transform itself into a hub for battery and EV manufacturing, reducing its dependence on oil. The kingdom is keen to secure access to lithium and other critical minerals to support this ambitious goal.

Chile presents attractive opportunities for Saudi investors. The state-run miner Codelco is currently seeking a partner for a major lithium project in the Maricunga salt flat. Additionally, the Chilean government has recently opened several other lithium deposits to private investment.

During his visit, Alkhorayaf, along with Manara CEO Pierre Chenard, participated in high-level meetings with Chile's mining ministry and key industry players. Discussions covered crucial topics such as the minerals supply chain, water supply issues, and lithium production.

The Saudi minister emphasized the urgency of their plans, stating, "We have a leadership that's very ambitious. We are serious to source it now ... as soon as possible." This urgency stems from Saudi Arabia's goal to commence domestic EV battery production in the near future.

To further strengthen bilateral cooperation, Alkhorayaf proposed establishing a collaborative group between the Saudi and Chilean governments. This initiative aims to explore potential areas of partnership and mutual benefit in the mining sector.

As Saudi Arabia continues its push into the global lithium market, this potential partnership with Chile could mark a significant step in the kingdom's economic diversification efforts and its ambitions in the EV industry. The coming months may reveal concrete developments in this evolving Saudi-Chilean mineral collaboration.

As Saudi Arabia continues its push into the global lithium market, this potential partnership with Chile could mark a significant step in the kingdom's economic diversification efforts and its ambitions in the EV industry. The coming months may reveal concrete developments in this evolving Saudi-Chilean mineral collaboration.

Top 5 Main Players in Lithium Batteries

The lithium-ion battery market is highly competitive and dynamic, with new players emerging and existing ones rapidly expanding. But as of now, these are generally considered the top 5 players:

1- CATL (Contemporary Amperex Technology Co., Limited):

This Chinese company has consistently held the top spot in global lithium-ion battery production for several years. Known for its innovation and large-scale production capabilities, CATL supplies batteries to major electric vehicle (EV) manufacturers.

2 - BYD (Build Your Dreams):

Another Chinese giant, BYD has rapidly grown in the battery market. They are not only a major battery producer but also a significant EV manufacturer, allowing them to integrate battery technology seamlessly into their vehicles.

3 - LG Energy Solution:

A South Korean company, LG Energy Solution is a major supplier to the global automotive industry. They have a strong focus on research and development and have made significant contributions to battery technology advancements.

4 - Panasonic:

A Japanese electronics conglomerate, Panasonic has been a pioneer in lithium-ion battery technology. They are a key supplier to Tesla and have a strong presence in the consumer electronics market as well.

5 - Samsung SDI:

Another South Korean company, Samsung SDI is a major player in the lithium-ion battery market. They have a strong reputation for quality and innovation, and their batteries are used in various applications, including EVs and energy storage systems.

Lithium Battery Market Size

The lithium-ion battery market is experiencing rapid growth, primarily driven by the increasing demand for electric vehicles (EVs).

While exact figures can vary slightly depending on the source and specific time period, here's a general estimate:

* - Market size in 2023: Approximately $54.4 billion

* - Projected growth rate: Around 20.3% CAGR from 2024 to 2030

It's important to note that these numbers are estimates, and the actual market size could be higher or lower. Additionally, the market is constantly evolving, with new players and technologies emerging.

Primary Sources of Lithium for Batteries

Lithium, the critical component of lithium-ion batteries, is primarily sourced from two main geological formations:

1. Salt Lakes (Salars): Primarily in the "Lithium Triangle" of South America, including Argentina, Bolivia, and Chile.

2. Hard-Rock Mines: Australia is the dominant producer of lithium from hard-rock mines, with significant deposits also found in Canada and the United States

Posted on: Jul 31 2024

|